Core points of view

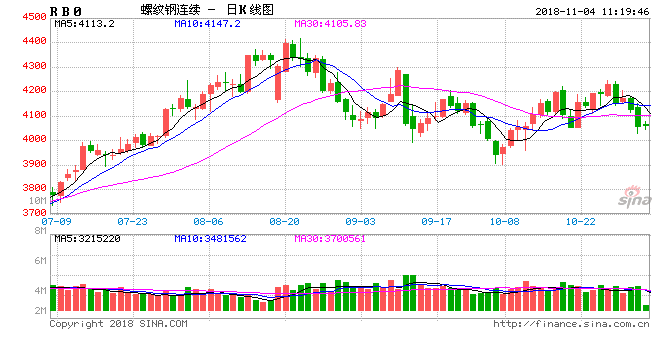

At present, the production restriction programs of the two major steel mills in Jiangsu have been determined, affecting the iron and water production of 110,000 tons/day and 180,000 tons/day respectively. In addition, from the end of October to the beginning of November, there is still demand for the construction period in the southern region, so the spiral steel(4060,10.00, 0.25 %) Futures still have the possibility of upward repair in the short term.

With the weakening of demand in the North, from late November to early December, resources in the North will be concentrated in East and South China markets, and the tight supply of building materials in the South will be improved, which may lead to a fall in prices.

In the short term, steel prices will continue to be volatile at high levels due to low inventories, high premium and temporary production restrictions.

Details:

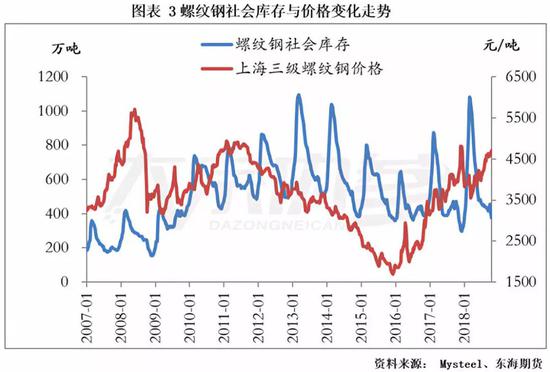

After the 11th long vacation, under the influence of temporary environmental protection and production restrictions and other factors, the stock of steel fell rapidly. Affected by this, the spot price of spiral steel rose significantly in October, and prices in some areas exceeded 5,000 yuan/ton. The main contract price of futures also followed. We believe that while the short-term support factors for the steel market remain, some medium-term losses have begun to appear, and steel prices are expected to fall in November.

In the short term, steel price support factors are still

In the short term, spiral steel futures are mainly supported by low inventory, high base difference and temporary production restrictions in East China. Due to the pessimistic macro expectations, the futures price trend in October was significantly weaker than the spot, and the current price difference continued to increase. The current main contract has reached 15 %(600 yuan/ton or more) of spot premium. In terms of inventory, after the 11th long vacation, the stock of spiral steel fell for three consecutive weeks, and it was 3.7768 million tons in the week ending October 26, setting a new low in the year. At the same time, during the Shanghai Import Expo in November, steel mills in Jiangsu Province may have restrictions on production to varying degrees. According to Mysteel's research, at present, the production restriction programs of the two major steel mills in Jiangsu have been determined, affecting the output of iron and water by 110,000 tons per day and 180,000 tons per day respectively. In addition, from the end of October to the beginning of November, there is still a rush period in the southern region. Demand, Therefore, screw steel futures still have the possibility of upward repair in the short term.

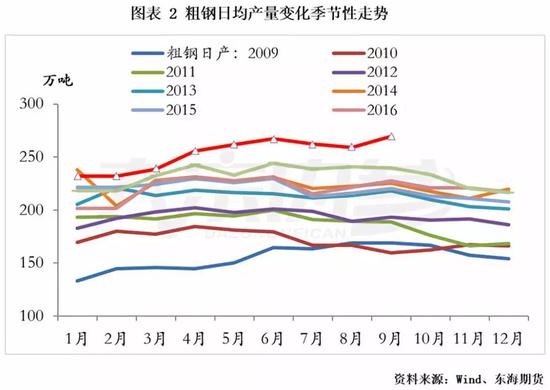

Supply peaks have passed during the year, but will continue to rise year-on-year

Under the background of environmental protection and limited production, domestic steel supply recovered significantly in September, and the daily output of crude steel and pig iron reached a record high. High-frequency data show that the production of the five major varieties increased to varying degrees in September, but the situation changed after October, showing that the production of threaded steel continued to rebound, while the production of the remaining varieties decreased to varying degrees. Mainly due to the high profit of spiral steel, combined with the current demand situation, it is expected that the supply pressure of spiral steel may gradually appear after mid-November.

In terms of overall supply in the fourth quarter, we believe that the peak of steel production in the past year has passed, but the supply pressure is still relatively large compared with the same period last year. Winter is generally a season of poor air quality in the year, and the Environmental Protection pressure is greater than the third quarter. With the gradual landing of the Environmental Protection production restriction policy and the implementation of the next three months of steel mill operating rate will be a large probability event. However, since the end of August, the Ministry of Ecology and Environment has repeatedly emphasized that "one size fits all" in the implementation of environmental production restrictions, and local production restrictions have also shown a detailed trend. The Environmental Protection restrictions that supported the rise in steel prices in the early stages have begun to appear. Marginal relaxation signs. Take the tangshan area as an example, according to mysteel related calculations, this year's fall and winter blast furnace peak production limit ratio of 33.82 %, down from 50 % in the same period last year. In addition, the newly announced Action Plan for Comprehensive Control of Air Pollution in the Fall and Winter of the Fen-Wei Plain 2018-2019 will lower the average concentration of PM2 .5 and the number of days of heavy pollution and above from 6 % of the consultation drafts to 4 %. So the overall fall and winter production limit is expected to be smaller than the same period last year.

Low season superimposed winter storage demand weakened, mid-to-late November or entered the passive replenishment stage

In October, due to the impact of the deadline, the entire steel market demand performance is relatively strong. High-frequency 237 traders across the country, the turnover of building materials, Shanghai spiral terminal purchases and we track Zhoudu apparent consumption has recovered significantly. However, it should be noted that since the end of October, domestic steel consumption has entered the low season from north to South. In October, although the volume of steel in construction has recovered significantly, it has mainly contributed to the southern and Eastern China, while the northern region has The transaction has begun to decline. The average day of the month was 35,000 tons, a decrease of 0.1 million tons from September; And historical data, every year from November to December Zhoudu apparent consumption will also have a significant decline. Therefore, it is expected that with the colder weather, the weakening demand will gradually expand to East and South China.

At the same time, the weak winter reserve demand and the south of the North Wood will also have a certain impact on the steel market. According to past experience, traders will perform a certain winter reserve every year from late November to early December until the spring. The strength of the winter reserve generally depends on the expectation of future prices and the cost of funds. At present, the discount rate of Shanghai large-value bank acceptance bill that reflects the cost of traders 'financing is 3.22 ‰(monthly interest rate), which is at a medium low level. However, the market's expectation of future prices is relatively poor, on the one hand, because the traders 'losses at the end of last year were more serious; On the other hand, it is because the market is generally pessimistic about macroeconomic expectations in the first half of next year; And the current level of spot absolute prices is also at a high level. According to our understanding and that of some traders, the average price will fall to 3900-4000 yuan per ton before considering the winter reserve. Therefore, it is expected that the demand for the winter Reserve will be weaker than last year. Later steel market from passive inventory transfer to passive inventory is more likely.

In addition, the rebound in steel prices since October has been mainly led by prices in East China and South China, which has continued to increase the price difference between North and South China. At present, the price difference between East China and Northeast China has exceeded 400 yuan/ton in South China and North China. Can cover freight costs. Therefore, with the weakening of demand in the North, from late November to early December, resources in the North will be concentrated in East and South China markets, and the tight supply of building materials in the South will be improved, which may lead to a decline in prices.

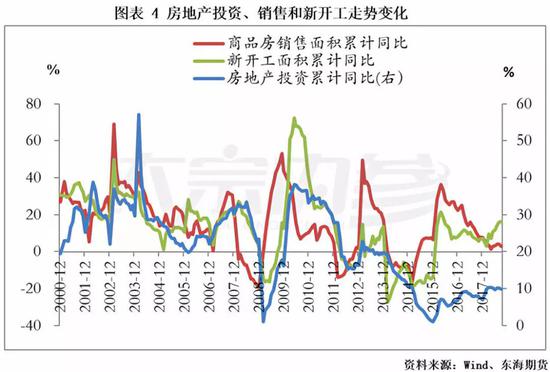

High probability of decline in medium-term demand

From the perspective of the main downstream industries of steel, real estate investment is still resilient, but there are hidden concerns in the medium term; Infrastructure investment continues to decline, and it will take time for the policy of steady growth to bear fruit. Manufacturing investment continued its earlier modest rebound.

In the first three quarters of this year, domestic real estate investment grew 9.9 % year-on-year, down 0.2 percentage points from January to August. However, this was mainly due to the rapid increase in land acquisition costs, which, after excluding land acquisition costs, led to real estate investment of -4.09 per cent in the first three quarters, an increase of 0.2 percentage points over the previous eight months. At the same time, the trend of divergence between the new start of construction and the sales trend is still continuing. This is mainly due to the fact that real estate companies have accelerated their sales to recover funds, but this deviation has actually increased the pressure on the deconversion of stocks in the later period. Commodity growth in the first three quarters was -13 per cent, and it has rebounded for seven consecutive months, and the current high frequency urban inventory consumption ratio has also increased to varying degrees. Recently, Xinhua re-issued the article stressed that the adherence to real estate control policies will not waver, coupled with the current increase in the number of land sales, land acquisition costs growth rate for three consecutive months, it is expected that the later real estate investment may continue to continue the previous months of decline.

In the first three quarters of this year, the growth rate of broad infrastructure investment was 0.26 % year-on-year, down 0.4 percentage points from the previous eight months, and continued to explore the bottom line. Since the third quarter, the state has introduced a series of policies to stimulate infrastructure, the speed of approval of the Development and Reform Commission's projects has been significantly accelerated, and local special debt issuance and fiscal expenditure has also been significantly increased. In September, fiscal expenditure rose 11.7 % year-on-year, up 8.4 percentage points from August. In the medium term, Infrastructure investment is expected to improve gradually. But given the cycle of infrastructure projects and the slow start of construction after November, we expect investment in infrastructure to continue to be weak for the next 1-2 months, and the government's bottom line policy may not be effective until the first half of next year.

In manufacturing, manufacturing investment in the first three quarters grew 8.7 % year-on-year, up 1.2 percentage points from the previous eight months; The sharp recovery in industrial profits last year and the surge in industrial prices in the middle and middle reaches of the year are the main reasons for the rebound in manufacturing investment. However, we believe that there is some downward pressure on investment in manufacturing in the later period. On the one hand, the profit growth rate of industrial companies has continued to decline since this year. The growth rate in September was only 4.1 % in a single month, down 5.1 percentage points from August. On the other hand, the overall performance of consumer durable goods consumption in the downstream is sluggish, and the total retail sales of consumer goods continue to hover below 10 %, and the retail sales of automobiles, home appliances, and communications equipment have dropped more significantly. At the same time, the domestic export growth rate of electromechanical products has fallen for five consecutive months. In the first three quarters, the growth rate was 13.5 % year-on-year, which was 0.4 percentage points lower than in January-August, and the probability of continuing to weaken in the later period was higher. If the investment in manufacturing falls later, it will further suppress the demand for industrial materials. In fact, the persistent increase in the price difference for threaded hot rolls(3762,59.00, 1.59 per cent) since August is also an example of the weakening of downstream manufacturing.

Based on the above analysis, in the short term, steel prices will continue to maintain high volatility under the effect of low inventory, high premium and temporary production restrictions. However, market volatility is increasing. After mid-November, from north to South, it will enter the low-demand season. At the same time, when the market price is high and the price difference between North and South is too large, it will face the weakening of winter reserve demand and the impact of the North. Double pressure. In addition, the major downstream industries in the first three quarters are basically weak, and this trend is expected to continue until the end of the year. Therefore, the steel market will show a downward trend in November. It is expected that the operating range will be between 3800-4400. It is proposed that unilateral short-selling opportunities above 4300 can be considered in the middle of the operation. In terms of arbitrage strategy, it is recommended to pay attention to the short-selling opportunity of the screw ratio(or consider the 1905 iron ore of the empty thread 1901(509, -2.50, -0.49 %) stone), and after 01 falls below 10 % on the spot, Thread 1-5 cross-stage reflexive strategy can be considered.

Mailbox:taxinqiao@163.com Website:m.sfquail.com

Shandong Xinqiao Industrial Co., Ltd. Copyright Technical support:Nuodun Network

Headquarters:0538-8151706 Fax:0538-8151704

Address:The new North Road of the steel market of Tai'ant

Branch:0538-5018001 Fax:0538-5018004

Address:Tai'an national Mountain Center